Here’s why a second round of PPP loans could fall short for battered small businesses

CHATTANOOGA, Tenn – Senate Majority Leader Mitch McConnell, R-Ky., quashed a new Covid-19 rescue bill hours after it was proposed on Tuesday, leaving small businesses uncertain about their future.

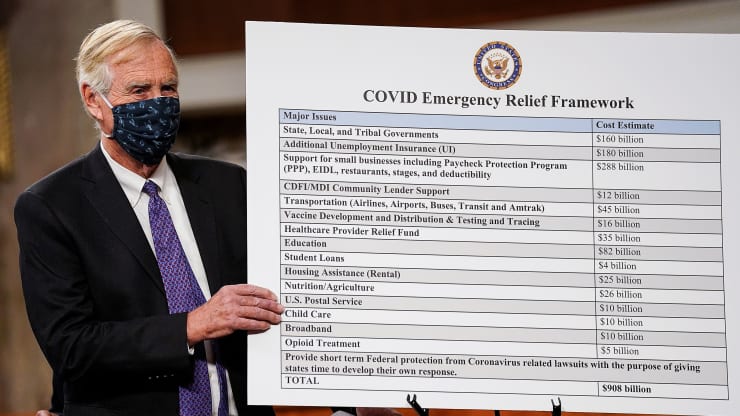

Bipartisan lawmakers introduced a $908 billion relief package on Tuesday morning. The measure was dead in the water by that afternoon, when McConnell rejected it.

The measure would have set aside $288 billion in aid for small businesses, including offering firms a second round of loans through the Paycheck Protection Program — a forgivable loan program established by the CARES Act this spring.

More from Smart Tax Planning:

Got a scary letter from the IRS? How to deal

Five steps business owners can take to trim their taxes

Spend down these tax-advantaged dollars or lose them

Recipients of PPP loans are generally eligible for loan forgiveness if they use at least 60% of the proceeds to cover payroll costs. Those who fall short of the threshold may be eligible for partial forgiveness.

McConnell’s veto sends lawmakers back to the drawing board, where they may have another opportunity to fine-tune business relief.

Merely offering more PPP funding might not be enough for cash-strapped businesses, tax professionals said.